Beyond 2015: What Does the Snowmobile Future Hold?

Hints of a bright snowmobiling future, but snow always rules

We’re going to pretend that we know the future. After all, we think that model year 2015 points to where the various sled makers are heading and how they are thinking. Of course, the big variable in all of future thinking centers on snowfall: when, where and how much.

The good news is that some of the Farmers Almanac versions nailed the 2013-2014 harsh winter scenario. That came off a less boisterous 2012-2013 winter, but one that primed the pump for exciting sled sales, which left snowmobile marketing managers smiling as though they had controlled the snow faucet. Sorry, guys, you look great when it snows and much less so when it doesn’t.

With everything from an 800cc trail hot rod 800 Indy to this extra-long tracked 550 Adventure, Polaris makes enough different Indy models to let you think of this “value” series as a distinct line of 2015 snowmobiles.

With everything from an 800cc trail hot rod 800 Indy to this extra-long tracked 550 Adventure, Polaris makes enough different Indy models to let you think of this “value” series as a distinct line of 2015 snowmobiles.But, based on the past two winter seasons and a firsthand look at the 2015 sleds, we’ll be bold and suggest that all of the snowmobile manufacturers are giddy in anticipation of very good early season sales. If the sled makers stayed true to their pre-season “special” Buy Now or be sorry promotions, then they should be genuinely optimistic. Consumers had some excellent incentives to write checks and order early. These programs really only work if the sled makers hold true to them.

Polaris led the way for such programs. Back in the day, Polaris was a struggling snowmobile manufacturer looking to generate cash flow in the non-traditional early spring sales period. Thanks to an astute Polaris executive running its Polaris/Canada operation in the 1970s, the Minnesota snowmobile pioneer tried a pre-season gambit whereby you put a deposit down and ordered early to guarantee that you got exactly the sled you wanted, even if it was a limited edition. The program worked well enough to catch the attention of the US-based parent company.

In following seasons, Polaris developed a corporate marketing program based on the Canadian results. That Canadian executive found himself promoted to full-fledged corporate vice presidential status and marketing genius. The then snowmobile-only company gained a strong pre-season cash flow that it had never enjoyed before with its seasonal product. The company relied on these pre-order spring sales for cash flow pretty much until the arrival of a year-round product, the Polaris ATV. Now, of course, Polaris has enough product lines to balance out seasonal downturns for sleds. Still, the company continues its early season program.

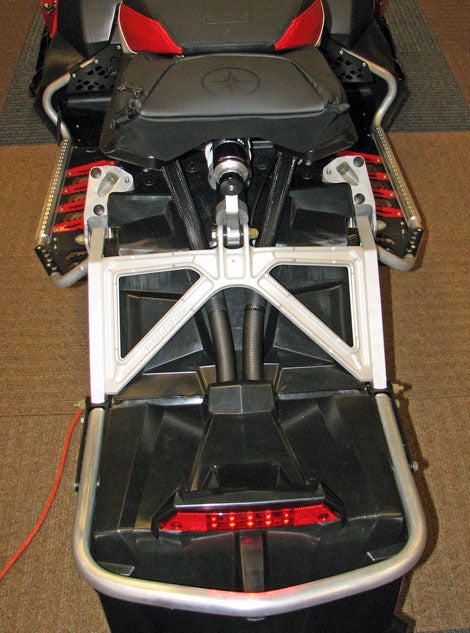

Future sleds will benefit from how Polaris re-thought the standard parallel rail rear suspension and arrived at its new-for-2015 Pro-XC design.

Future sleds will benefit from how Polaris re-thought the standard parallel rail rear suspension and arrived at its new-for-2015 Pro-XC design.Interestingly, Polaris nearly killed its program by underestimating its consumers. Thinking they were getting the “best” sled deal in the springtime, consumers would pop for the guarantee of getting a new sled for the best deal. That was the promise, implied or real, that Polaris made. But, for a few seasons, when snow was scarce and sleds weren’t selling very well, Polaris sort of reneged on that deal, offering bigger discounts at the end of December trying to move sleds out of the dealerships before January and the next year. Consumers saw that “best buy” promise evaporate and decided that the next time they were looking for a sled, they’d wait. They didn’t automatically buy early, since they figured Polaris would make better deals later in the season. And the company did.

Once Polaris “marketeers” figured it out, they worked hard to rebuild consumer confidence in its early-season ordering program. As you look at Polaris’ 2015 program, you’ll note that a deposit on a 2015 Polaris snowmobile can get you a sled that can be customized up to 20,000 ways to make it distinctly yours. Polaris got the message.

So, too, did the other sled makers. Ski-Doo claims to only offer its unique Summit with a T3 package and 174-inch track-print if you ordered early. Yamaha created a limited edition series of Viper models in special colors and fitted with special equipment for those who ordered early. Arctic Cat had its offers, too.

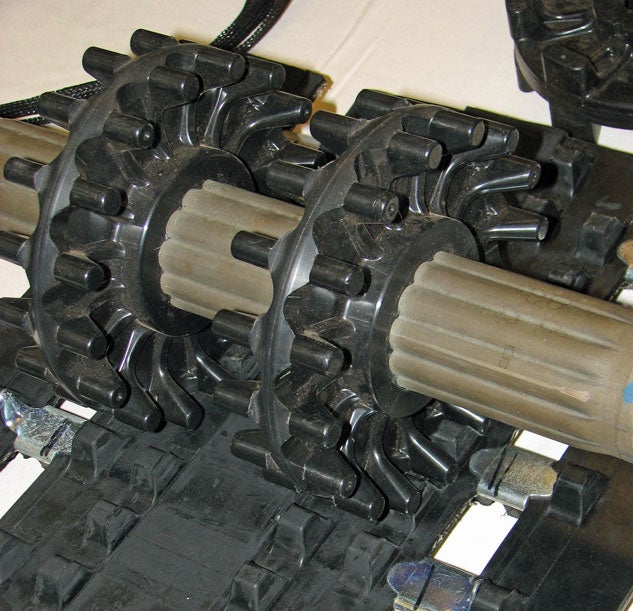

Future snowmobiles will benefit from serious re-thinking in engine design, such as the direct-injection system Arctic Cat used on its new 600cc two-stroke twin.

Future snowmobiles will benefit from serious re-thinking in engine design, such as the direct-injection system Arctic Cat used on its new 600cc two-stroke twin.These springtime specials serve two purposes: generate cash and generate a way for manufacturers to plot their potential sales mix. If two-up touring sleds proved more popular than a sporty trail model, the manufacturing experts would make assumptions. One, of course, would be that they had misread the market, which isn’t that likely. But it would alert them to a potential shift in the market. These programs also allow them an opportunity to better judge which models and what equipment stirs consumer demand.

One Year Later: The Arctic Cat/Yamaha Deal

Based on these facts and other observations we’ve noted for model year 2015, we expect that consumers will see a truer picture of what sleds cost going forward into the future. Polaris makes no pretense that the Indy line is its “value” line. In our estimation, it’s quite a value line up with everything from a hot rod 800cc trail racer to an extra-long tracked and incredibly versatile fan-cooled “adventure” two-up. The Indy series in itself could represent a fifth manufacturer’s line of snowmobiles. But it is simply a parcel of the Minnesota brand’s 2015 line, which includes totally reworked Rush and Switchback models carrying premium equipment and base pricing that reflects it.

Ski-Doo fully expects that by virtue of being Number 1 in the marketplace, it can dictate a big bump in sales heading into the future. We don’t dispute their thinking, but we’ve been down this trail before and seen long, lean years when such plans went awry. If winter snows continue as they have for the past two seasons, this is good thinking. We assume that all sled companies have a Plan B if predicted El Nino returns and winters turn mild with minimal snowfall. Past thinking that winter would stay the course resulted in huge volumes of unsold models and dealers suffering under the financial weight of carrying them into future years.

Ski-Doo leads the industry in sales and intends to build on its successes by providing sleds for everyone from hot rod trail riders to off-trail powder hounds.

Ski-Doo leads the industry in sales and intends to build on its successes by providing sleds for everyone from hot rod trail riders to off-trail powder hounds.But, we also see reason to think that if winter continues just somewhere near normal that consumers can expect some nifty new sleds heading our way. The 2015 Polaris Rush borrows construction from the RMK but carries an all-new 800cc two-stroke twin that we figure will power lighter and more powerful Polaris powder sleds into 2016 and beyond. Polaris and Arctic Cat/Yamaha riders will most likely benefit from anti-locking brake options.

At least the engine wars seem to have settled in, although we expect that Ski-Doo may come with a cleaner “next generation” E-Tec for its two-strokes and possibly an advanced 1200cc four-stroke to replace the existing 1200 4-Tec Triple and join the more efficient ACE 600 and 900 motors to take advantage of their throttle-by-wire and multi-mode performance options.

Power and performance highlight many of Ski-Doo’s efforts, but the company’s engineering staff also devotes itself to making the ride quieter and vibration free with its emphasis on Quiet Track technologies.

Power and performance highlight many of Ski-Doo’s efforts, but the company’s engineering staff also devotes itself to making the ride quieter and vibration free with its emphasis on Quiet Track technologies.Other than that, all sled makers other than Yamaha, have a 600cc and 800cc two-stroke and a bevy of one-liter four-strokes for sport trail riding, utility and touring. Expect engine enhancements, but anticipate that power output levels should stay close to what they are now.

How Weather Affects Snowmobile Sales

Yamaha and Arctic, for now anyway, share in each other’s fate. Yamaha continues to state it will have an all-new, all-Yamaha model by 2018 to mark its 50th anniversary in snowmobiling. We hope that’s true. Arctic Cat will evolve its deep snow sleds and work on a lighter, faster replacement for its existing tall spindle Procross models. Don’t expect that to come much before 2020. Or, maybe around 2018 and coincidental with Yamaha’s new model.

These vintage all-star Yamaha performance sleds lead us to expect a brand new Yamaha snowmobile to celebrate the company’s 50th anniversary in snowmobiling.

These vintage all-star Yamaha performance sleds lead us to expect a brand new Yamaha snowmobile to celebrate the company’s 50th anniversary in snowmobiling.Now that the early season ordering season comes to a close, sled makers can settle in on finalizing marketing plans on how best to get the rest of us to stop in at their dealers and see what’s new. We’ll probably wait until late summer events like the annual Hay Days in Minnesota unofficially kicks off the new season. When we do, we’ll keep looking for hints of the future in what’s displayed. It will be there.

Your Privacy Choices

Your Privacy Choices